RETIREMENT, INVESTMENT, & INSURANCE SERVICES

Allegent offers a broad range of products and services to meet the needs of our members. Whether you want to open your first checking account, want to start building credit, are ready to buy your first home, or want to start investing for retirement, we can help you reach your financial goals.

Put Your Financial Future in the Right Hands

Experience You Can Trust

Our vision at Allegent Community Federal Credit Union is to provide our members with superior financial solutions, comprehensive products, and an unparalleled service experience. The partnership you have with us extends to Allegent Financial Services, available through CFS*.

Whether you are looking for overall financial guidance, assistance with a specific financial goal, creating a comprehensive financial plan, or want a second opinion, we are here to help. Our CFS* Professionals are experienced in working directly with members like you and can provide individualized service that is tailored to helping you meet your specific financial goals.

Services include:

Reviewing your current financial plan

Retirement planning

IRA, 401(k), 403(b), 457 plans, and TSP Rollovers

Retirement income strategies

Education funding

Life and long-term care insurance

Whether it is developing sound solutions for your retirement, generating income, or protecting your assets through insurance, Allegent Financial Services, available through CFS* is here to:

Listen to your financial needs

Provide impartial advice to help you make informed decisions

Be dependable and responsive

Meet Our CFS* Professionals

Costas Grekis

Wealth Advisor

CUSO Financial Services, L.P.

Nick Song

Financial Advisor

CUSO Financial Services, L.P.

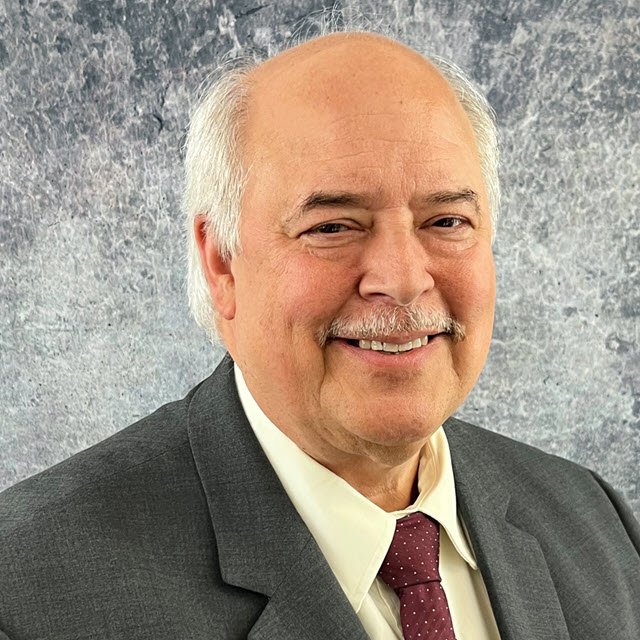

Don Militzer

Financial Professional

CUSO Financial Services, L.P.

Helping you work toward your financial goals is my number one objective. Working together, I’ll help you make sound financial decisions consistent with your comfort level, investment timeline, and goals. We can start small and grow or evaluate and build upon any existing financial plans. The end result will be a strategy designed to help you build, preserve, use, and transfer assets in a more advantageous way. Periodically, we’ll review your situation and make adjustments as needed. It just makes sense — as your life changes, so do your financial needs, and I’ll be here for you at every stage of your life.

I have a strong history of working with credit union members, their family, and their friends. I have access to a wide variety of investment and insurance products. Specifically, we can make sure you have solid answers to these key questions:

Is your retirement money invested properly?

Will you have enough income in retirement?

What should you do with an existing retirement plan from a previous employer?

How will you pay for a child’s or grandchild’s education?

Financially, what would happen to your family if you died?

How will you pay for long-term care?

It’s easy to get started. Please contact me for a no-cost, no-obligation consultation.

Education

B.A., Finance, University of Pittsburgh

B.A., Marketing, University of Pittsburgh

Earned CRPC® (Chartered Retirement Planning CounselorSM) designation, College for Financial Planning

Affiliations

NAIFA, National Association of Insurance & Financial Advisors

Career Highlights

CRPC® designate (Chartered Retirement Planning CounselorSM)

Professional Services

Wealth Management

Retirement Planning

Personal Financial Assessments

Insurance Planning

Investment Management

Financial Planning

Education Funding

I help individuals and families at Allegent Financial Services, available through CFS* located at Allegent Community Federal Credit Union, address their financial goals by providing sound financial advice based on eight years of experience in the industry. As a financial professional, I want to improve the lives of my clients. My experience with clients from all different walks of life has enabled me to create long-term relationships with my clients and their families.

In my spare time, I enjoy life with my family and my Corgi. I also enjoy working on cars and attending car enthusiast shows.

Professional Services

General Investment Management

401(k) Planning

Education Funding

Life Insurance Planning

Investment Management

Wealth Preservation

Retirement Income Planning

I help individuals and families at Allegent Financial Services, available through CFS* increase their financial confidence. With more than 34 years of experience in the financial services industry, I have been able to build relationships with generations of families. I am able to listen to their concerns and offer ongoing guidance to help them prioritize their goals.

For 26 years, I was a local board member of NAIFA (National Association of Insurance and Financial Advisors), helping to promote a favorable regulative environment and educating other insurance and financial advisors on ethical and professional conduct.

In my spare time, I am Chair of the Dormont Civil Service Commission. I also enjoy playing guitar, being outdoors, and fishing with my grandchildren.

Education

Bachelor’s Degree – University of Pittsburgh

Affiliations

Chair – Dormont Civil Service Commission

Emeritus member – Dormont Boosters

Professional Services

Comprehensive Financial Guidance

Life Insurance

Long-Term Care Insurance

Investment Management

Retirement

Education Funding

Further Details

To schedule a complimentary, no-obligation appointment with an Allegent Financial Services CFS* Professional, call (412) 642-2875 x2860.

Check the background of this financial institution’s investment professionals on FINRA’s BrokerCheck at brokercheck.finra.org

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

Financial Advisors are registered to conduct securities business and licensed to conduct insurance business in limited states. Response to, or contact with, residents of other states will be made only upon compliance with applicable licensing and registration requirements. The information in this website is for U.S. residents only and does not constitute an offer to sell, or a solicitation of an offer to purchase brokerage services to persons outside of the United States.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.